Why A Specialized Collections Company Makes Sense for Your Community Association by Axela

Is a Specialized Collections Company Right for Your Association?

In good times or bad times, community associations (Condos and HOAs) will experience some level of delinquencies that affect the entire association. As a not for profit business your association depends on timely payments every pay period to maintain services to members of the association. Failure to effectively act on a delinquent account does a disservice to the community and to the delinquent member as well. By allowing a member to sink deeper and deeper in debt, the association only makes it more difficult for them to remedy their problem. Engaging a Legal Process (sending the file to your community association attorney) the association may just be incurring additional expenses that eventually will be paid for by the good-paying owners.

Often HOA boards of directors are reluctant to migrate delinquencies to collection agencies from their community association attorney. This article looks at the key benefits and concerns regarding collection agencies for community associations, examines the current state of collections, and helps associations understand why a specialized collection agency for community associations offers tremendous opportunity to collect their money at very no cost and no risk.

The Promise of a Specialized Collections Company

Almost every community association looks towards their community association attorney to manage their delinquencies. Yet community association attorneys are not prepared to do the work necessary to effectuate collections (outbound calls, credit reporting, skip tracing, dedicated inbound call center), and the costs are usually beyond what they recover. Collection agencies have traditionally been performance-based and will collect their fees and costs only upon a successful collection event. Collection agencies are concerned with only one aspect of business and that is the successful and cost-effective recovery of maintenance fees and other charges that may appear on the ledger (fines & violations, special assessments).

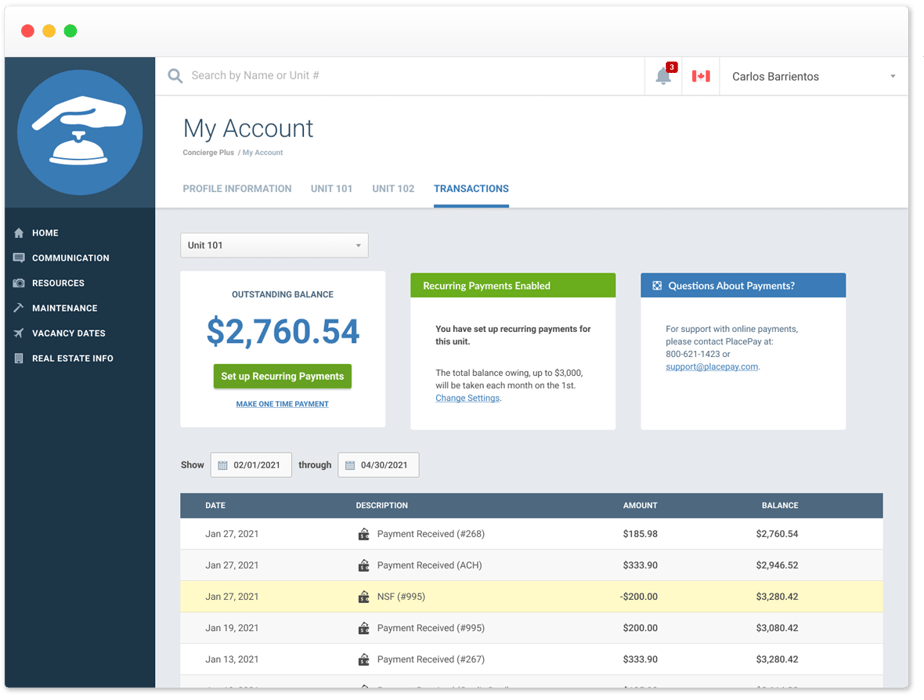

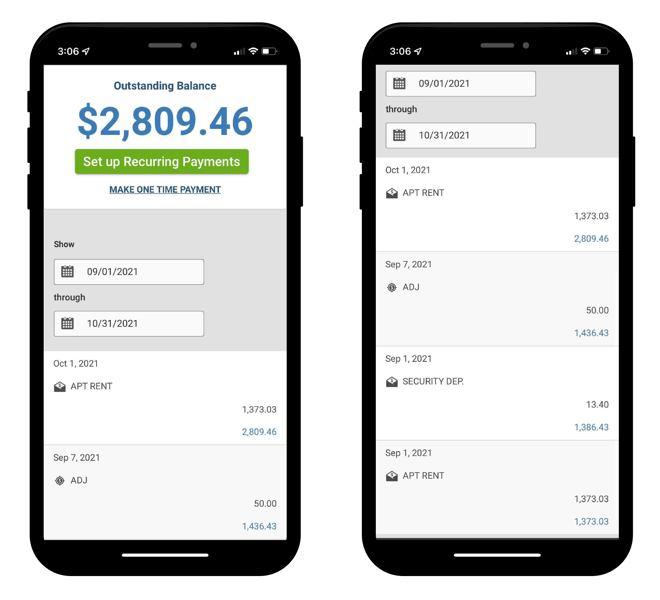

Operational Excellence and Reporting

The most important feature of an enterprise-level collections solution is its ability to communicate with delinquent owners. Both inbound calls and outbound calls must be managed by highly trained and accredited specialists. When seeking out a collections company for your HOA ask if there is a dedicated portal for delinquent owners to resolve their issues. Boards of Directors and their management companies need to have access to clear and legible reporting. Payment applications must be handled according to governing documents and state statutes. Strict compliance with Federal and State consumer rules and regulations is imperative.

Cost Savings

Community Association law firms require payment regardless of the outcome of the file. These costs often are beyond the amounts recovered. Collection Agencies are merit-based and are only paid upon a successful collection effort. In the specialized field of collections for community associations boards of directors should not, and in some cases, cannot allow any portion of their maintenance fees to be allocated as boards must be faithful to their association’s budget. Fees and costs of collections should be charged and passed through to delinquent owners, and in the case of an unsuccessful collection effort these fees should not become the burden of the association (including costs for filing a lien)

Concerns Regarding Collection Agencies

It’s easy to see why these key features are the motivators for moving your collections to a specialized collections company and away from a community association attorney. Yet, many boards of directors are reluctant to change what they have traditionally done in the past, and of course, they will be advised by their own counsel not to remove a collection file from their firms.

FDCPA, TCPA, & FCRA Compliance

Any vendor who performs services for a community association must have the proper insurance to protect the association from liability. Violations of consumer protection laws should be a great concern.

- Know and be in compliant with Federal and State Regulations.

- Report delinquencies to credit bureaus in compliance with the FCRA.

- Ensure all telephone calls are following TCPA regulations.

A community association must perform their due diligence and be sure that their collection agency is not only bonded but properly insured. Associations should also be concerned that the customer service representatives of the collection agency are professionally trained and have designations from collection industry trade organizations such as ACA (The Association of Credit and Collection Professionals).

Statutes & Governing Documents (CC&Rs)

Of significant concern to community associations should be a collection agency’s adherence to governing documents and state statutes that relate to condos and HOAs. Payment application, timelines, statutory compliance to the lien process, and notification are of paramount concern to community associations, especially regarding collections. Zero defect execution of the collections process must be the standard practice. Collection agencies need to:

- Perform flawless underwriting of each ledger.

- Verify property ownership.

- Impeccably review governing documents and by-laws and understand the state statutes where they are doing collections.

Conclusion

With increased scrutiny of the collection industry, it is more important than ever for community associations to engage the right company with the most sophisticated technology that can support their missions. They should:

- Compare and document standards, guarantees, and performance levels to ensure that prospective collection agencies are truly best-in-class solution providers.

- Ask for collection agency references and connect with these references to get a true feel for the providers’ service, product and

It is also imperative that community associations increase efficiency, transparency, and reporting to members of the community. Collection Agencies that specialize in working with community associations are the best way to go. The right collection agency just makes sense for communities – Do not allow delinquencies to erode your community.

About Axela Technologies

Axela Technologies is a licensed collection agency exclusively serving community associations in the United States. Axela Technologies realizes that in the field of collections, community associations have been an under-served industry. By offering their core product Easy Collect ™ to community associations Axela Technologies has recovered millions of dollars that community associations might have otherwise written off. Give Axela a call today and get a free no-obligation collections analysis today to see if a specialized collections company is right for your association.

Tags: Collections

The Attorneys and Staff in the

The Attorneys and Staff in the