SO WHERE WILL PRICES GO? By Eric Glazer, Esq.

SO WHERE WILL PRICES GO?

By Eric Glazer, Esq.

I think last night’s 60 Minutes episode made it clear that for some, living in their condominium unit may simply become unaffordable. The question is……which condos will suffer the most and which other forms of housing are most likely to retain their values and even go up.

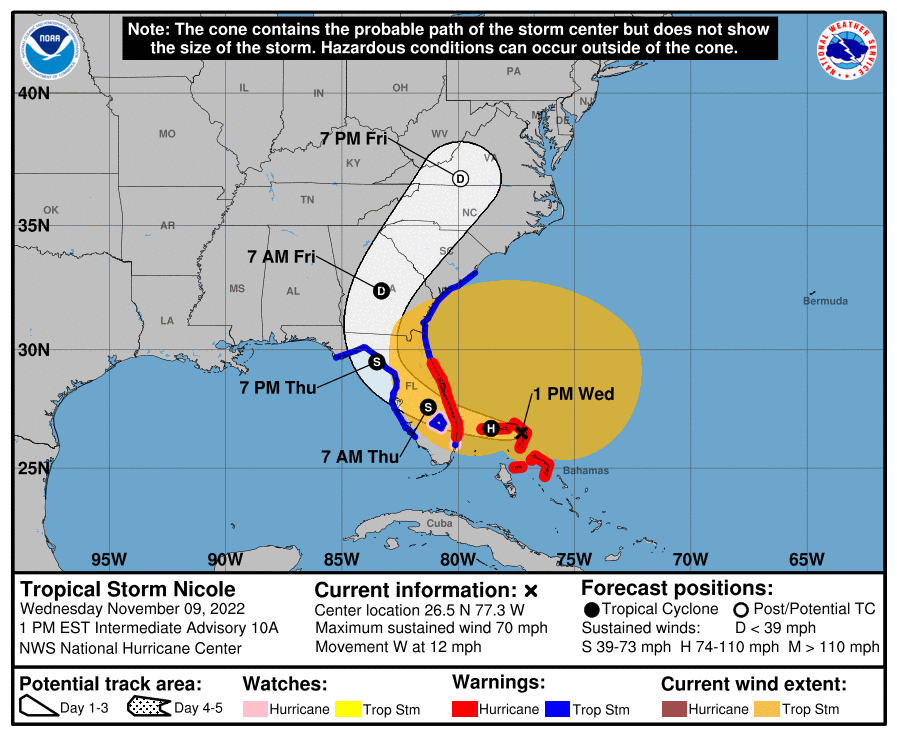

Everyone is freaking out that all condominium living will soon become insanely unaffordable but that simply isn’t true. Remember, these new inspection laws only kick in after 25 years if your condo is on the beach or within 3 miles of the coast. They don’t kick in for 30 years for all other condos. So, if your condo is new, these new inspections may not apply to you for decades. Relax.

What else do we know? Full funding of reserves start in 2025 and they can’t be waived. Does that spell doom and gloom for everyone? Not necessarily. If your condominium has always been doing the right thing and has been fully funding reserves, these new laws requiring the full funding of reserves may not have a financial effect on you at all. On the contrary, if you have been living in a condominium that has been waiving reserves for years, or even decades, you are in trouble. You have a lot of catching up to do. But what did you expect? You were never putting away money for future repairs? Did you think your building would never need repairs? If it did need repairs, did you think these repairs would magically be paid?

Remember, these mandatory inspections, mandatory repairs and mandatory reserves only apply to condominiums of 3 stories or more. So obviously, if your condominium is under three stories, you won’t be subject to mandatory inspections or mandatory reserves. Something tells me, your home will be in high demand.

Of course, if you live in an HOA, the new inspection and reserve laws won’t apply to you either. No doubt in my mind, condo dwellers will soon be looking to switch to the HOA way of life.

If you live in one of those condos above 3 stories that is 30 years of age or older and never reserved a dollar, it’s going to be hard to sell your unit. Buyers are more educated now and realize they would be buying into a financial nightmare. If you want to sell, your price will definitely have to factor in, what the new buyer is about to pay for those inspections and repairs.

On the contrary, people who own condos under 3 stories or who live in HOAs will be in the driver’s seat as none of these costs will be passed on to their potential buyers.

I’m no realtor……..but this is how I see it.