Differentiating Class A, B, and C Office Space

Many of our members take the time to complete projects using the County Codes that are in place, While there are so many companies that cut corners or a Management company that looks at prices we have to ask? How do you Value the Buildings you manage?

We have one of the Top Condo, HOA and Property Management Directories in Florida. Through the many Categories clients can find only the Best of the Best to have their maintenance requests performed on time, up to Code in their buildings and properties from Jacksonville to the Keys.

When only the best will do, Find companies all over Florida ready to help you!

Remember: “Skilled labor isn’t cheap; cheap labor isn’t skilled”. by James Terry of GreenTeam Service Corp.

Office buildings are generally classified into one of three categories: Class A, Class B, or Class C. Standards vary by market, and each category is defined in relation to its counterparts. Building classification allows a user to differentiate buildings and rationalize market data — that said, classification is an art, not a science. While a definitive formula for each class does not exist, the general characteristics are as follows:

Class A

These buildings represent the newest and highest quality buildings in their market. They are generally the best looking buildings with the best construction, and possess high-quality building infrastructure. Class A buildings also are well located, have good access, and are professionally managed. As a result of this, they attract the highest quality tenants and also command the highest rents.

Class B

This is the next notch down. Class B buildings are generally a little older, but still have good quality management and tenants. Oftentimes, value-added investors target these buildings as investments since well-located Class B buildings can be returned to their Class A glory through renovations such as facade and common area improvements. Class B buildings should generally not be functionally obsolete and should be well maintained.

Class C

The lowest classification of office building and space is Class C. These are older buildings and are located in less desirable areas and are often in need of extensive renovation. Architecturally, these buildings are the least desirable, and building infrastructure and technology is outdated. As a result, Class C buildings have the lowest rental rates, take the longest time to lease, and are often targeted as re-development opportunities.

The above is just a general guideline of building classifications. No formal standard exists for classifying a building. Buildings must be viewed in the context of their sub-market; i.e., a Class A building in one neighborhood may not be a Class A building in another.

Tags:

Budgets,

Maintenance & Service Articles,

Management News

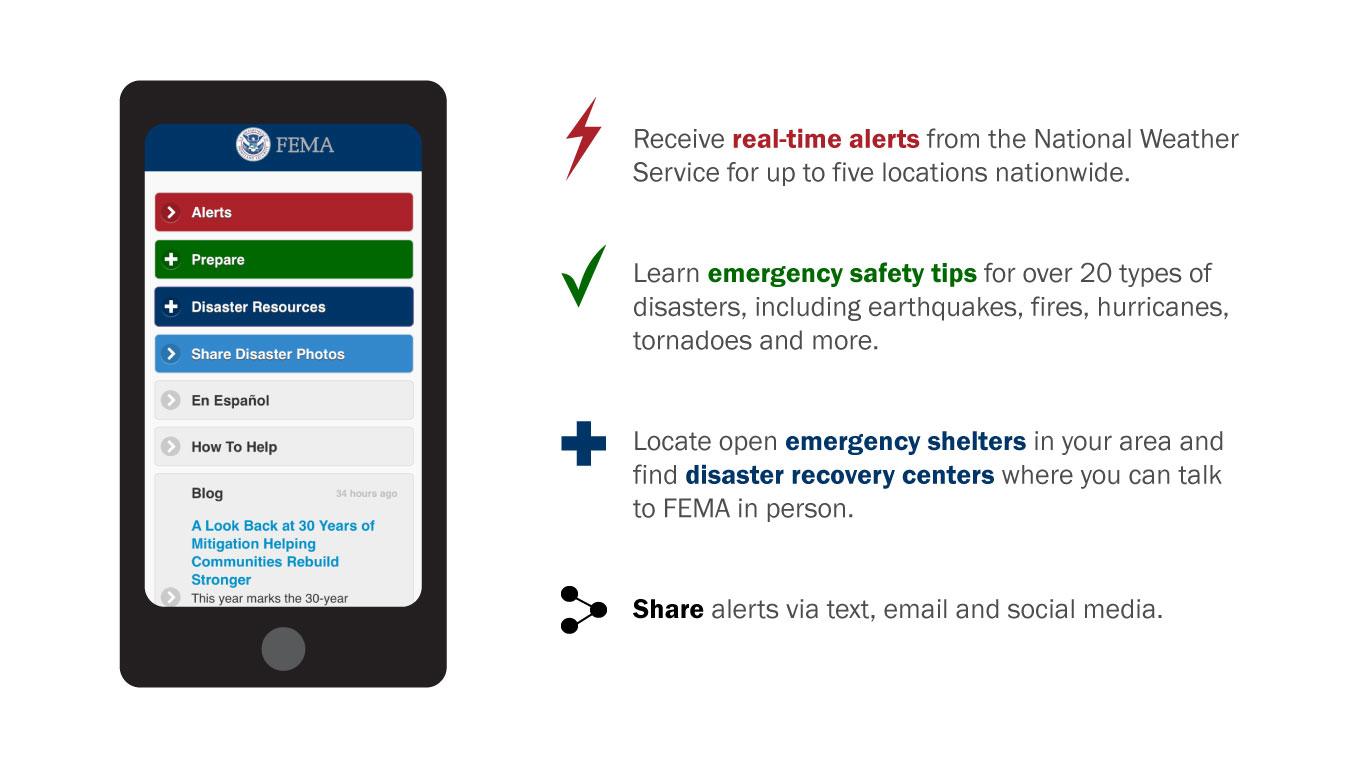

Floods are the most common natural disaster in the United States. As we are approaching Hurricane Season we want you to be safe!

Floods are the most common natural disaster in the United States. As we are approaching Hurricane Season we want you to be safe!