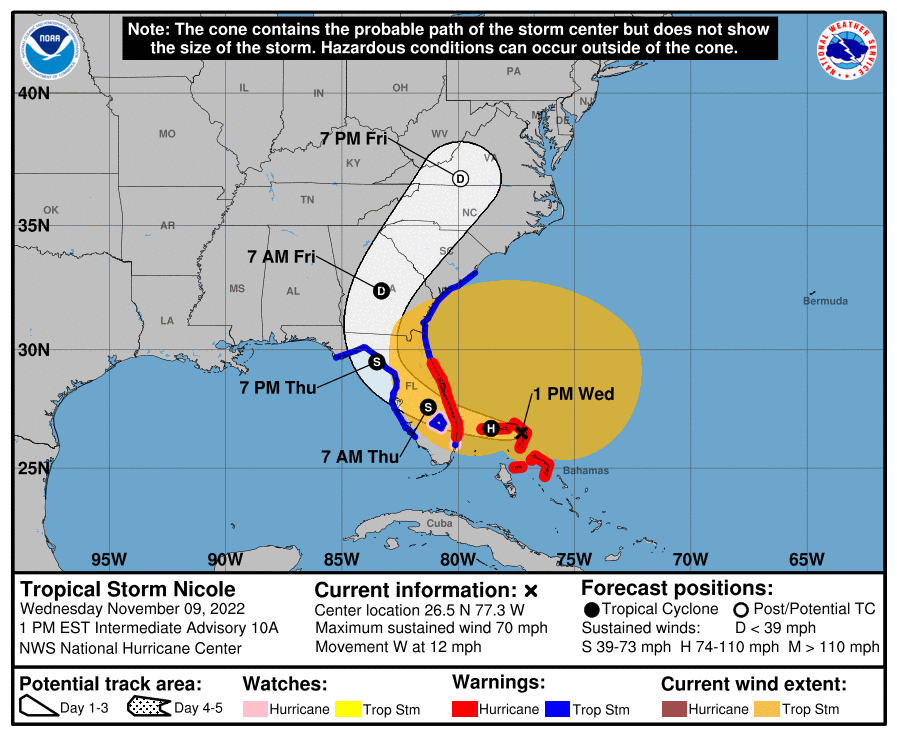

It’s an unspoken secret among homeowners that hurricane damage in Florida is inevitable.

It’s not a question of “if”. It’s a question of “how long before it happens to me?” So before this year’s storm season kicks off, it’s a good idea to educate yourself on the hurricane damage claim process. The more you know, the better you’ll be able to navigate these waters when disaster strikes.

It’s not a question of “if”. It’s a question of “how long before it happens to me?” So before this year’s storm season kicks off, it’s a good idea to educate yourself on the hurricane damage claim process. The more you know, the better you’ll be able to navigate these waters when disaster strikes.

In this post, we’ll talk about different types of hurricane damage claims, what you can expect from your insurance company, and how to get help from a professional claims adjuster.

COMMON TYPES OF HURRICANE DAMAGE CLAIMS

The most common types of damage after a hurricane is damage to your windows from flying debris. This is almost inevitable, but it’s important to document the condition of your windows before the storm.

As a matter of fact, this advice applies to all types of damage. Take pictures before the storm. They can be your only way to prove that the damage happened due to the hurricane, and not weeks or months beforehand.

Siding, roofing, and doors are also frequently damaged in hurricanes. Again, this is due to high winds and flying debris or falling trees, so this kind of damage can happen many miles inland.

Another common type of damage is fires. It’s counterintuitive to think about fire damage when there’s rain falling down like God’s pouring buckets out of the sky, but it’s a real risk. Power surges and outages can cause appliances to malfunction, while leaks and flooding can cause short circuits and electrical fires.

Finally, there’s water damage. This doesn’t always happen due to flood water, either. It can happen due to a roof leak or window damage, or even because of a failed appliance leaking after the storm. Even mild water damage can lead to mold, so look out for leaking around windows or around your roof joists.

WHAT IS COVERED?

The short answer is that it depends on what kind of insurance you have. Basic homeowners insurance will cover most hurricane damage, but not damage from flooding. For example, you may be covered for water damage from a leaky roof, but not for a flooded laundry room wrecking your washer and dryer. A flood insurance policy will cover this gap in coverage. We talk more about this in our article on water damage.

Many parts of Florida are considered high-risk areas, so insurance companies place further restrictions on wind damage. In this case, you’ll need to have windstorm coverage in order to get reimbursed to damage to your roof or windows. If you live in a high-risk area, getting this coverage is a no brainer. It can be expensive, but it costs less than paying for these repairs out of pocket.

WHAT ISN’T COVERED?

There are a couple of things that your insurance definitely will not cover.

- The first is damage due to negligence. For example, if you’re under an evacuation order and you leave a bunch of appliances plugged in, causing a fire, the insurance company may deny your claim due to negligence.

- The second is damage to your vehicle. Even if it’s parked in a carport or garage, your vehicle will not be covered by your homeowners or flood insurance. Fortunately, it may be covered by your car insurance if you’ve purchased the right kind of coverage.

HOW TO DEAL WITH DAMAGE AFTER A HURRICANE

The first thing to keep in mind is that your home may not be safe to return to. Listen to authorities, and don’t return to your home if your neighborhood is supposed to remain evacuated.

Once you’re cleared to return, get your camera ready. Just as you did before the storm, take pictures of everything. Eventually, you’re going to need to clean up, but the claims process can drag on for months. If there’s a dispute, before and after pictures can make the difference between a successful claim and a failed one.

You may be tempted to throw out damaged furniture and appliances. Resist that temptation. Sadly, claims adjusters have to deal with fraud on a regular basis, so they’re liable to give you the stink-eye if you tell them that all your damaged furniture is at the dump, along with your 70-inch flat screen TV and your brand new, top of the line dishwasher. Save everything until the adjuster has come out, this will improve the validity of your hurricane damage claim.

On the same token, never sign an invoice with a contractor that doesn’t have an exact cost specified. Some shady contractors will write something like “for insurance proceeds” on their invoice, then try to get the whole value of the claim, instead of just the cost of their own work.

HOW CAN A PUBLIC ADJUSTER HELP?

A public adjuster is a claims adjuster who works for you instead of the insurance company. They get paid a percentage of the proceeds from your hurricane damage claim, so the more you receive, the more they make. This gives them a strong incentive to make sure you get every penny you’re entitled to.

A public adjuster is a claims adjuster who works for you instead of the insurance company. They get paid a percentage of the proceeds from your hurricane damage claim, so the more you receive, the more they make. This gives them a strong incentive to make sure you get every penny you’re entitled to.

Oftentimes, insurance adjusters will lowball repair estimates by using prices for the cheapest possible materials. Sometimes, they’ll even avoid going to damaged areas of the house to avoid having to make a note of the damage. A public adjuster works with you to find and document every bit of damage, and advocates for you with the insurance company.

If you think a public adjuster can help you, Contact Stellar Public Adjusting Services using our free web form. If your need is urgent, feel free to call us at 305-570-3519.

Our team of adjusters has a combined experience of several decades, and all of them work in-house. This means you’ll be working directly with a member of our team, and not with an independent contractor. Focus on rebuilding your home and your life. Leave the stress and paperwork to the experts.

The Maus Law Firm

The Maus Law Firm

It’s not a question of “if”. It’s a question of “how long before it happens to me?” So before this year’s storm season kicks off, it’s a good idea to educate yourself on the hurricane damage claim process. The more you know, the better you’ll be able to navigate these waters when disaster strikes.

It’s not a question of “if”. It’s a question of “how long before it happens to me?” So before this year’s storm season kicks off, it’s a good idea to educate yourself on the hurricane damage claim process. The more you know, the better you’ll be able to navigate these waters when disaster strikes. A

A