How to effectively communicate with condo/ homeowners

Written By : Phillip Livingston

While there’s no one-size-fits-all approach to condo communication, there are some basic principles and strategies that can help you maximize communication. For instance, we can all agree that using digital communication tools is faster and more efficient than outdated paper and mail.

While there’s no one-size-fits-all approach to condo communication, there are some basic principles and strategies that can help you maximize communication. For instance, we can all agree that using digital communication tools is faster and more efficient than outdated paper and mail.

Read on to find out how technology and sound communication strategies can facilitate smooth operations and cohesion with homeowners.

-

Communicate as frequently as possible

One of the best ways to capture and maintain unit owners’ attention is to communicate with them frequently. Property management software such as Condo Control Central simplifies the process for you. It offers a discussion forum where unit owners can voice their opinions in a safe and confidential manner.

Residents can use this feature to report property damage in the common areas, and you’ll be able to moderate the forum by adding pre-defined topics.

The event planner tool also makes it easy to inform and update residents about upcoming community events such as get-togethers and AGM meetings.

Tired of printing documents and posters every time you update community bylaws? Say goodbye to printing costs and upload updated documents straight to your community’s file library. It has quick search functionality and allows you to seamlessly notify residents when you upload a new document. Now you’ll have no excuse but to keep unit owners updated on every move.

Make sure your state allows for the electronic transfer of large documents because it’s not legal in every state.

People generally don’t like to actively seek out information so you need to make it easy for them. Otherwise, no-one is going to go out of their way to read the rules unless they’re made visible. Going digital will not only help you to cut costs while captivating people’s attention, but it also simplifies the communication process. Using property management software forums means that you don’t have to rely on residents to open an email, or log in to a website.

But, it’s important to modulate the information you make available to residents online. Intelligently designed communication strategies speak volumes and will help you manage and reduce conflict.

Like most condo associations, your condo declaration stipulates how often your board should meet. It’s important to include residents in HOA meetings to promote transparency and honesty. The minimum requirement in most state regulations is for the HOA board to meet annually to plan the yearly budget. But, it helps to hold regular meetings in-between to keep residents in the loop about important issues.

If you want to find out how often your condo board should meet, check the association’s bylaws for detailed information. Most bylaws have a minimum meeting frequency of five to six times a year. It’s important to note that this is merely a suggestion, and the board can choose to meet more or fewer times than that, based on the needs of the community.

Granted, things like weather conditions can contribute to the frequency of board meetings. Associations that in areas with extreme winters may hold regular meetings to deal with issues like snow removal or lawn maintenance. Some associations need to hold frequent meetings to deal with tenant disputes and other kinds of drama. Larger condo associations with 30, 50 or more units may also meet frequently due to unique circumstances.

The important thing is to address problems as they arise and do so publicly. Don’t allow things to fester as this may lead to detached involvement from homeowners. For instance, if an HOA board holds six meetings in a year, then homeowners should be present for at least half of those meetings.

-

Leverage your online presence

Every association should have a website and social media presence. This makes it easier to raise awareness about the latest association news, meeting minutes, etc.

Plus, you can control the amount of information included on the website and who has access to it.

Most associations use social media platforms like Facebook and LinkedIn as well as association blogs as a way to keep community members in the loop about important news and happenings. Through private groups within these platforms, you can safely and effectively share meeting minutes, community alerts, invitations, and announcements.

The only downside to using public social networks is that you don’t have control over the platform itself. Facebook or LinkedIn’s community and privacy rules can change at any moment. This can affect the way you communicate with association members and compromise privacy. After all, social media doesn’t offer the level of confidentiality required when sharing certain information.

Since these platforms aren’t designed with condo associations in mind, they may not have certain functions you’d find in dedicated property management software.

Social media also comes with issues like out of control comments that cause misunderstandings and communication barriers. For instance, it’s easy for comments posted by board members to be misconstrued as a representation of the board itself, when it’s only the perspective of a single board member. Situations like this can create a hostile environment and lead to unnecessary strife.

This is just one example of how Facebook can instigate controversy trough miscommunication. It’s difficult to moderate comments and conversations that happen on the platform, hence the fighting that often happens on Facebook and other social media websites.

It’s better to communicate with homeowners using an internal platform. That way, you can moderate the conversation and address questions in an orderly fashion. An open forum is a great way to do th

is, along with Control Central’s dedicated announcement feature.

The website builder feature from Condo Control Central is ideal because it allows you to create a customized platform for your community. Here, you can safely share important and mundane information alike. This includes things like your pest control schedule to your recreational event calendar, board meeting schedule, planned improvements and parking requirements to name but a few.

It’s the best way to ensure confidentiality and privacy when communicating with unit owners electronically. It also encourages ongoing interaction between unit owners and can foster a strong sense of community.

-

Encourage disinterested unit owners by showing the financial upside

Are you having trouble with disinterested unit owners? Then you should point out a few reasons why they should take an interest in association affairs. Most absentee unit owners are that way because they don’t live in their units and simply rent them out as an investment property.

In such cases, it helps to incentivize meeting attendance with something like a free gift card or a percentage off from their assessments. At the end of the day, these types of owners are interested in the financial value of the property. So, they will take part in association meetings and affairs if it means maximizing their bottom line or investment.

We can’t stress this enough. Transparency is paramount in a condo association because you don’t want unit owners to ever feel alienated or unheard. Transparency is the easiest way to avoid disgruntled unit owners while making sure that you’re sharing all the right information with them.

For the best results, we recommend you consult with state regulations to see what the requirements are. Most states call for regular association board meetings that involve unit owners in every major decision.

The last thing unit owners want is to find out about an important decision via email or text notification. Especially if it affects the value of the property or their quality of life, which it probably will. Everything should be discussed in an open board meeting, and the board should give unit owners due notice before each meeting.

Unfortunately, association boards have been coming up with new ways to exclude board members, much to their detriment. One popular approach is to hold “working sessions” which are board meetings meant to exclude homeowners. The argument commonly used by board members is that they don’t want any interruptions from unit owners.

Even if the board is not planning to make motions during the meeting, community members must be informed of the meeting so they can attend if they want to.

This is the basis of transparency and the first step to building trust and open communication with your community.

Lack of communication is one of the biggest challenges HOAs and condo associations face today. This usually happens because the board fails to share decisions made on the backend. But, it’s important to share as much as possible with homeowners, keeping in mind that that the more transparent you are the more they will trust you.

It might be helpful to distribute regular newsletters either on a monthly or quarterly basis to keep community members in the loop about important issues. Even when an HOA board is experiencing problems with unauthorized renters, it’s important to share these issues so community members know what the board is dealing with.

Don’t forget to distribute the meeting minutes as soon as possible. This could be anything from a few days to a few weeks from the meeting depending on how fast the board approves them. Meeting minutes are a form of communication too and can help to shift perceptions about board transparency.

HOA boards should go beyond legal requirements when it comes to transparency and make financial records available to unit owners. That’s because financial transactions are often a leading cause of suspicion in condo associations and HOAs.

We recommend a yearly audit to improve transparency and the budget mail-out feature from Control Central is a lifesaver. It offers customized mail-out templates that you can use to digitally and automatically mail-out condo fees to residents.

Tags:

Condo and HOA,

Management News,

Management Tools

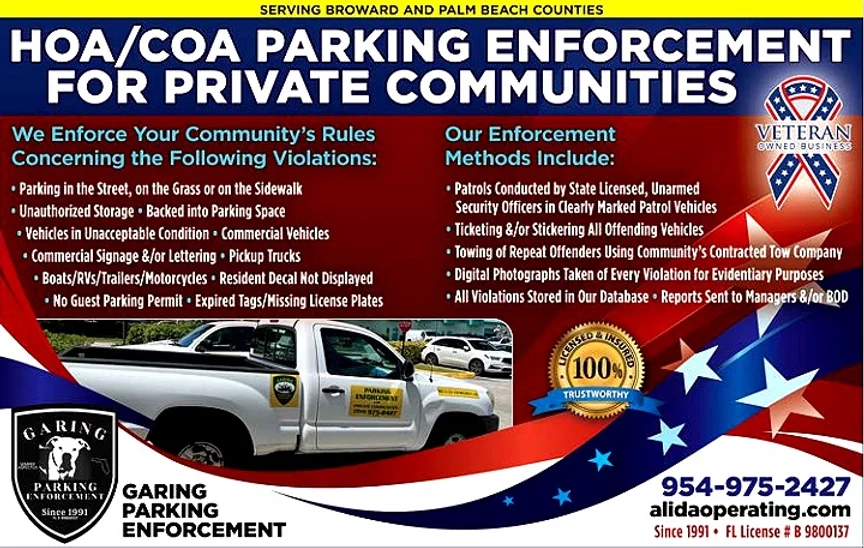

We pride ourselves on providing invaluable services to HOAs/COAs and their property managers throughout S. Florida that facilitate the improvement of safety and appearance of their communities while preserving the integrity of property values. Our first division, Garing Parking Enforcement, was started in 2007 to help communities regain and maintain compliance with their vehicle restrictions and parking regulations.

We pride ourselves on providing invaluable services to HOAs/COAs and their property managers throughout S. Florida that facilitate the improvement of safety and appearance of their communities while preserving the integrity of property values. Our first division, Garing Parking Enforcement, was started in 2007 to help communities regain and maintain compliance with their vehicle restrictions and parking regulations.

While there’s no one-size-fits-all approach to condo communication, there are some basic principles and strategies that can help you maximize communication. For instance, we can all agree that using

While there’s no one-size-fits-all approach to condo communication, there are some basic principles and strategies that can help you maximize communication. For instance, we can all agree that using

We are Valcourt Building Services, the premier provider for waterproofing, window cleaning, and restoration services. With over 30 years of experience, we’ve performed tens of thousands of repairs and maintenance on the complete

We are Valcourt Building Services, the premier provider for waterproofing, window cleaning, and restoration services. With over 30 years of experience, we’ve performed tens of thousands of repairs and maintenance on the complete  building envelope. So no matter what your building requires, we have the knowledge and expertise for all of your exterior maintenance needs.

building envelope. So no matter what your building requires, we have the knowledge and expertise for all of your exterior maintenance needs. If you have a commercial property in the Florida/Southeast US market, Valcourt is the premier provider for all your restoration needs. As a specialty contractor that has been waterproofing and restoring commercial building exteriors for over 30 years, we know the issues inside and out.

If you have a commercial property in the Florida/Southeast US market, Valcourt is the premier provider for all your restoration needs. As a specialty contractor that has been waterproofing and restoring commercial building exteriors for over 30 years, we know the issues inside and out.

Is your security system equipped to help you monitor your property on a 24/7 basis? If you are fortunate enough that your facility still has the same security needs as when you initially installed your security system, and that system hasn’t been rendered obsolete in recent years, it could still cause issues in the future.

Is your security system equipped to help you monitor your property on a 24/7 basis? If you are fortunate enough that your facility still has the same security needs as when you initially installed your security system, and that system hasn’t been rendered obsolete in recent years, it could still cause issues in the future.